The Kelly Criterion — Does It Work?

This article is originally published at https://quantstrattrader.wordpress.com

This post will be about implementing and investigating the running Kelly Criterion — that is, a constantly adjusted Kelly Criterion that changes as a strategy realizes returns.

For those not familiar with the Kelly Criterion, it’s the idea of adjusting a bet size to maximize a strategy’s long term growth rate. Both https://en.wikipedia.org/wiki/Kelly_criterionWikipedia and Investopedia have entries on the Kelly Criterion. Essentially, it’s about maximizing your long-run expectation of a betting system, by sizing bets higher when the edge is higher, and vice versa.

There are two formulations for the Kelly criterion: the Wikipedia result presents it as mean over sigma squared. The Investopedia definition is P-[(1-P)/winLossRatio], where P is the probability of a winning bet, and the winLossRatio is the average win over the average loss.

In any case, here are the two implementations.

investoPediaKelly <- function(R, kellyFraction = 1, n = 63) {

signs <- sign(R)

posSigns <- signs; posSigns[posSigns < 0] <- 0

negSigns <- signs; negSigns[negSigns > 0] <- 0; negSigns <- negSigns * -1

probs <- runSum(posSigns, n = n)/(runSum(posSigns, n = n) + runSum(negSigns, n = n))

posVals <- R; posVals[posVals < 0] <- 0

negVals <- R; negVals[negVals > 0] <- 0;

wlRatio <- (runSum(posVals, n = n)/runSum(posSigns, n = n))/(runSum(negVals, n = n)/runSum(negSigns, n = n))

kellyRatio <- probs - ((1-probs)/wlRatio)

out <- kellyRatio * kellyFraction

return(out)

}

wikiKelly <- function(R, kellyFraction = 1, n = 63) {

return(runMean(R, n = n)/runVar(R, n = n)*kellyFraction)

}

Let’s try this with some data. At this point in time, I’m going to show a non-replicable volatility strategy that I currently trade.

For the record, here are its statistics:

Close

Annualized Return 0.8021000

Annualized Std Dev 0.3553000

Annualized Sharpe (Rf=0%) 2.2574000

Worst Drawdown 0.2480087

Calmar Ratio 3.2341613

Now, let’s see what the Wikipedia version does:

badKelly <- out * lag(wikiKelly(out), 2) charts.PerformanceSummary(badKelly)

The results are simply ridiculous. And here would be why: say you have a mean return of .0005 per day (5 bps/day), and a standard deviation equal to that (that is, a Sharpe ratio of 1). You would have 1/.0005 = 2000. In other words, a leverage of 2000 times. This clearly makes no sense.

The other variant is the more particular Investopedia definition.

invKelly <- out * lag(investKelly(out), 2) charts.PerformanceSummary(invKelly)

Looks a bit more reasonable. However, how does it stack up against not using it at all?

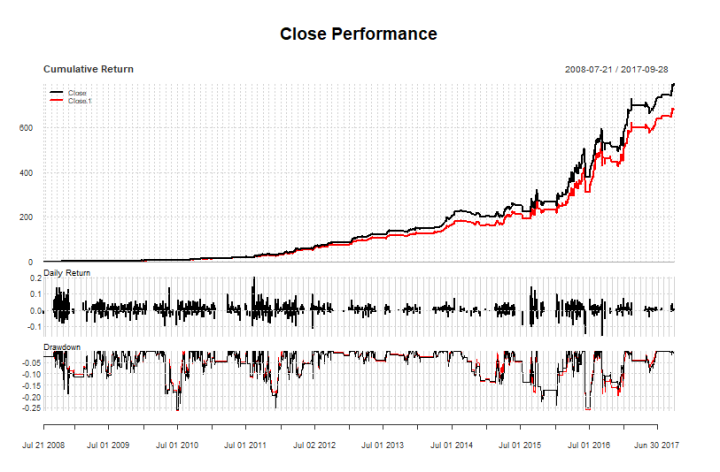

compare <- na.omit(cbind(out, invKelly)) charts.PerformanceSummary(compare)

Turns out, the fabled Kelly Criterion doesn’t really change things all that much.

For the record, here are the statistical comparisons:

Base Kelly

Annualized Return 0.8021000 0.7859000

Annualized Std Dev 0.3553000 0.3588000

Annualized Sharpe (Rf=0%) 2.2574000 2.1903000

Worst Drawdown 0.2480087 0.2579846

Calmar Ratio 3.2341613 3.0463063

Thanks for reading.

NOTE: I am currently looking for my next full-time opportunity, preferably in New York City or Philadelphia relating to the skills I have demonstrated on this blog. My LinkedIn profile can be found here. If you know of such opportunities, do not hesitate to reach out to me.

Thanks for visiting r-craft.org

This article is originally published at https://quantstrattrader.wordpress.com

Please visit source website for post related comments.